Our Investment Methodology

Disciplined Investment Solutions

Tailored to your Needs

Our investment methodology is designed for your peace of mind.

The first thing we do is to understand your long-term goals, and your risk appetite. Once these are known, our team determines the ideal balance between debt, equity and other assets for you.

Our investment management team is led by professionals with extensive qualifications like CFA Charter and CFP designation and they bring to table more than a decade-long experience in investment management, research and analysis.

The most common feedback we receive from those who have placed their funds with us is, “Your process gives us great peace of mind!”

Our Principles

At Truemind Capital, our principles are grounded in disciplined, research-driven decision-making.

Your portfolio allocation responds to moves in the market, moving to debt when our investment team believes stock market risk is high, and back into equity when equity is cheap, and potential returns are high.

These moves are governed by our regular risk assessment meetings, and the wealth of our experience. Our discipline and rigor maximises your return, and minimizes guesswork.

Research, as well as our own experience, shows that this flexible, tactical asset allocation makes the most of market moves, reduces volatility in your wealth, and fetches you a significant out-performance over the long term

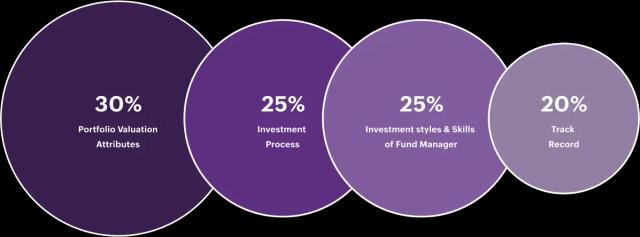

KEY FACTORS

Asset Allocation

Research across the world has shown that Asset Allocation - largely between equity and debt - contributes 80% to the return on your portfolio. Our work is designed to optimise asset allocation for each investor, based on your

Investment Horizon

Liquidity Requirement

As markets are constantly moving, we continue to fine-tune your portfolio based on our assessment of market valuation, possible volatility, and the principles of mean reversion.

KEY FACTORS

Scheme Selection

Delivers the balance 20% of your return, and our investment analysts are regularly monitoring the performance of fund houses and schemes across the spectrum of Indian and global markets, to identify the most successful fund managers and schemes that fit your investment needs.

Five-Step Investment Methodology

Identifying Asset Classes: Determine broader asset classes like equity, debt, and gold, along with sub-asset classes, based on the current investment environment.

Curating Asset Allocation: Develop a suitable asset allocation considering risk-reward assessments across different asset classes, aligning with the client's risk appetite, investment horizon, liquidity needs, and mode of investment.

Applying Investment Principles: Utilize mean reversion principles, educated assumptions, and tactical asset allocation to prepare a customized investment plan.

Scheme Recommendation: Recommend schemes after thorough research and analysis of qualitative and quantitative parameters, with quarterly reviews.

Portfolio Review and Rebalancing: Regularly review, monitor, and rebalance the portfolio to maintain appropriate asset allocation aligned with changes in the investment environment, aiming to maximize returns while minimizing downside risk.

Clients are encouraged to periodically review and revisit their investment plans to stay abreast of market condition changes, ensuring the best possible portfolio allocation aligned with the latest investment strategy.