What's Covered In Our

Financial Planning Services?

Retirement Planning

Children Education Funding

Insurance Review

Income Tax Strategies

Estate Planning

Truemind Capital Financial

Planning Process

Here's What To Expect!

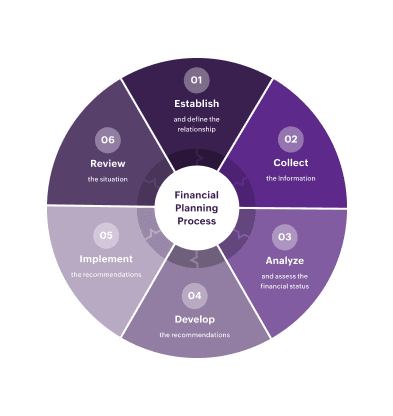

Establish and define the relationship with the client

We begin by informing you about the financial planning process, our services, competencies and experience. After a satisfactory discussion, we will execute the financial planning engagement.

Collect the client’s information

This is the fact-finding stage where we want to understand the personal goals you envision, as well as your constraints, and preferences. Our team will collect sufficient quantitative and qualitative information relevant to the scope of the financial planning engagement.

Analyze and assess the client’s financial status

We'll conduct a thorough assessment of your current financial situation, including assets, liabilities, income, and expenses, to check the ability to achieve financial objectives and stated personal goals.

Develop the financial planning recommendations and present them to the client.

Our team will create an investment strategy that matches your risk tolerance and investment goals. We employ a diversified approach to maximize returns while managing risk with “what if” scenarios and stress testing of the plan.

i. Asset Allocation: We will identify the mix of asset classes that suit your goals, time horizon, and comfort level. Our review considers all your assets, regardless of whether we will help you manage them, such as business interests, real estate, and other holdings.

ii. Investment Planning: Once we finalize an appropriate asset allocation strategy, we will recommend the types of investments that best meet your needs.

Implement the financial planning recommendations

After we mutually agree on all the aspects of financial planning and investment management, it will be time for us to put the plan into action.

Review the client’s situation

Financial planning is not a one-time event; it's an ongoing collaborative partnership that requires regular monitoring and adjustments. We'll continuously review your plan, check in periodically on your open action items and make necessary adjustments to keep you on track towards your financial goals.